Apple will hold the “It’s Show time” media event on Monday. Most observers expect the the giant to announce its long-expected video service. Rather than Apple launching a classic Netflix-style subscription video-on-demand (SVOD) service, all signs point toward a new and enhanced version of Apple’s popular iTunes store and the associated “TV” app for mobiles, according to Ovum.

More of an update than a new service launch, the new platform will host Apple’s originals and the iTunes transactional video-on-demand (TVOD) store, and it will aggregate a broad range of third-party TV and OTT video services, the business intelligence firm predicts. Here are the key points from Ovum’s report:

Apple’s new service won’t be available to non-Apple devices. Apple is also opening iTunes video content for viewing on non-Apple devices through AirPlay 2, which allows playback on third-party smart TVs. The streaming service launch is expected in in the first half of this year (maybe even this month), with international rollout starting in the second half of 2019.

Apple makes much more money selling third-party services than it does selling TVOD [TV on demand] content in iTunes. In TVOD, according to Ovum analysis, iTunes’ global market share dropped from 70% in 2011 to 22% in 2018 (still worth $1.81 billion). Unlike with TVOD, Apple has increased its share of global retail over-the-top video revenue share, from 5% in 2016 to 10% in 2018.

Apple’s aim is clearly to drive device owners back to iTunes, using its original content as a carrot (reportedly originals will be made available free to Apple device owners, and content may even be preinstalled in the app). Once customers are in iTunes, Apple will encourage them to browse TVOD catalogs and to sign up for third-party streaming services – and the assumption must be that Apple will want to partner with forthcoming D2C services from Disney, WarnerMedia, NBCUniversal, and others.

Apple’s new service will take the best of Amazon and Netflix. All in all, Apple’s strategy will take bits and pieces from some of the key services – high-end originals (such as Netflix), aggregation of third-party services (such as Amazon Prime Channels), and proactive curation of TVOD content (Amazon again) – to a captive base of over 600 million Apple devices and replaces the closed Apple ecosystem playback with one that promises a much more user-friendly customer experience.

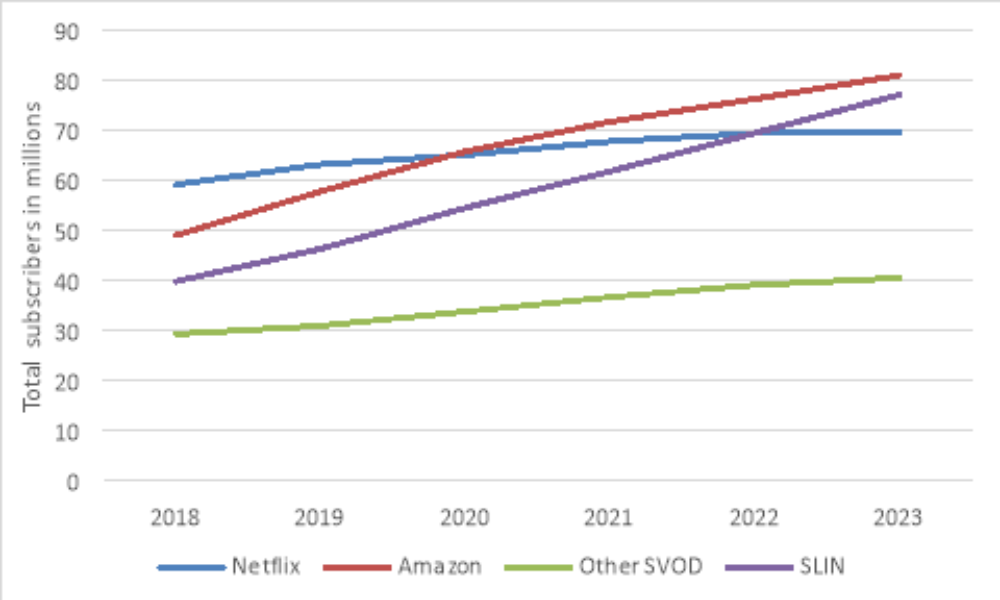

Hybrid services like the one Apple will launch will take 33% subscription market share by 2023. Netflix’s global market share is likely to stay stable at around the 20% mark, while Amazon’s will increase somewhat, reaching 12%. Apple has clearly made the decision that rather than building its own Netflix service, re-intermediating pay TV for the OTT is the best way forward to build a strong strategy for the coming online world of the 2020s. In as far as the 2010s belonged to Netflix and SVODs, the 2020s are going to belong to services that aggregate and allow consumers to build their own entertainment package from multiple on-demand and linear channel services.