Starting later this year, customers will be able to pay for an iPhone directly from Apple Card over 24 months with no interest.

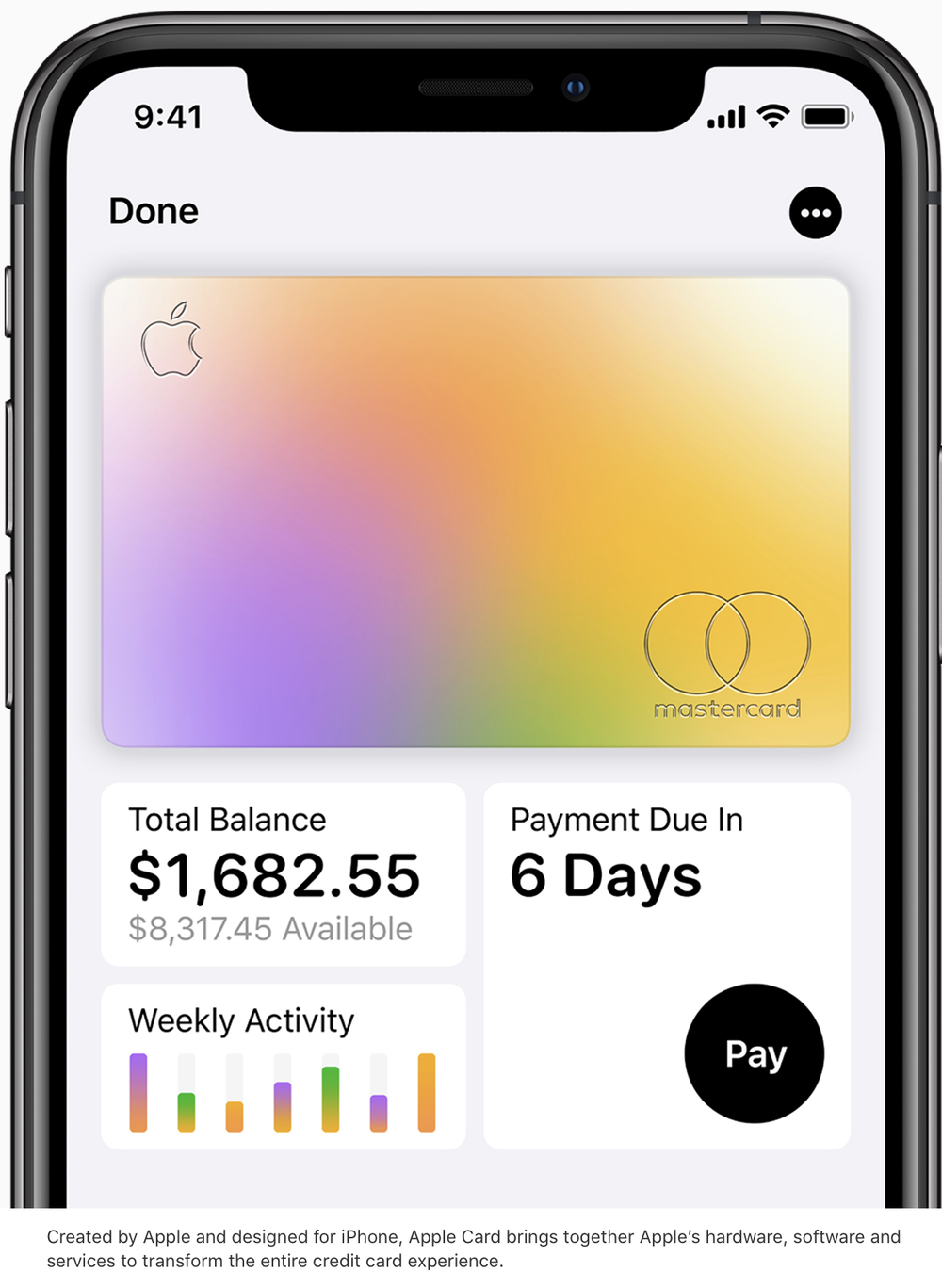

Plus, you’ll still be able to take advantage of the card’s features. It has no fees, encourages customers to pay less interest, offers an easy-to-understand view of spending and provides a new level of privacy and security, according to Jennifer Bailey, Apple’s vice president of Apple Pay. This launch follows the Apple Card preview earlier this month, during which a limited number of customers were invited to apply early.

Apple Card’s rewards program, Daily Cash, gives back a percentage of every purchase as cash on customers’ Apple Cash card each day. Customers will receive 2% Daily Cash every time they use Apple Card with Apple Pay, and 3%Daily Cash on all purchases made directly with Apple, including at Apple Stores, apple.com, the App Store, the iTunes Store and for Apple services — and, now a new iPhone.

CEO Tim Cook said Apple feels the Apple Card has been the most successful credit card launch in the U.S. ever. Discussing the company’s financial results for its fiscal 2019 fourth quarter that ended Sept. 28, he added that Apple Pay revenue and transactions more than doubled year-over-year. There were more than three billion transactions in the quarter—exceeding PayPal. Cook says there are now more than 6,000 Apple Pay issuers worldwide.