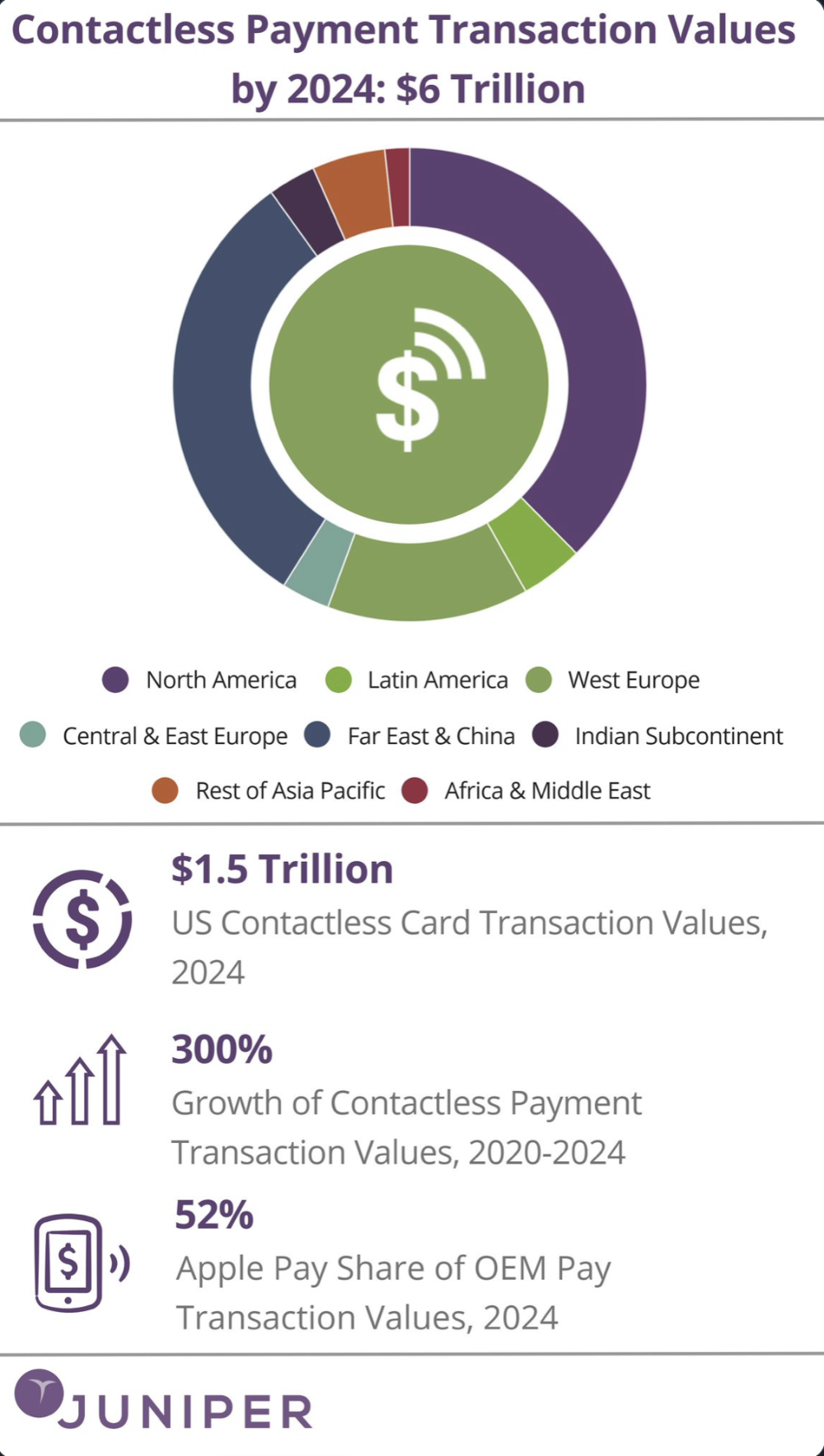

New data from Juniper Research forecasts that global contactless transaction values will reach nearly $6 trillion in 2024, up from $2 trillion in 2020. The research group identified the rollout of contactless cards in the U.S. and improvements in China’s contactless POS [point-of-sale] infrastructure as key drivers of this increase, as well as strong growth from Apple Pay.

Juniper Research anticipates that contactless cards will experience significant growth in the U.S., with transaction values surpassing $1.5 trillion in 2024, rising from $178 billion in 2020. The research found that growth will be fueled by the promotion of contactless cards by major U.S. banks, reductions in the costs associated with issuing contactless cards in the U.S. and their increasing use in the ticketing space.

Juniper found that Apple Pay will account for a 52% share of original equpment manufactuer [OEM] Pay transaction values, up from 43% in 2020. The expansion of Apple Pay’s user base in key regions, including Far East & China and Europe, will drive growth, as well as the extension of Apple’s reach outside OEM Pay through its Apple Card initiative, per the research group.

“Apple is now leading the space, owing to its unified ecosystem,” research author Susannah Hampton says. “Competitors, including Google and Samsung, must continue to expand the reach of their services in order to make strides in the market.”