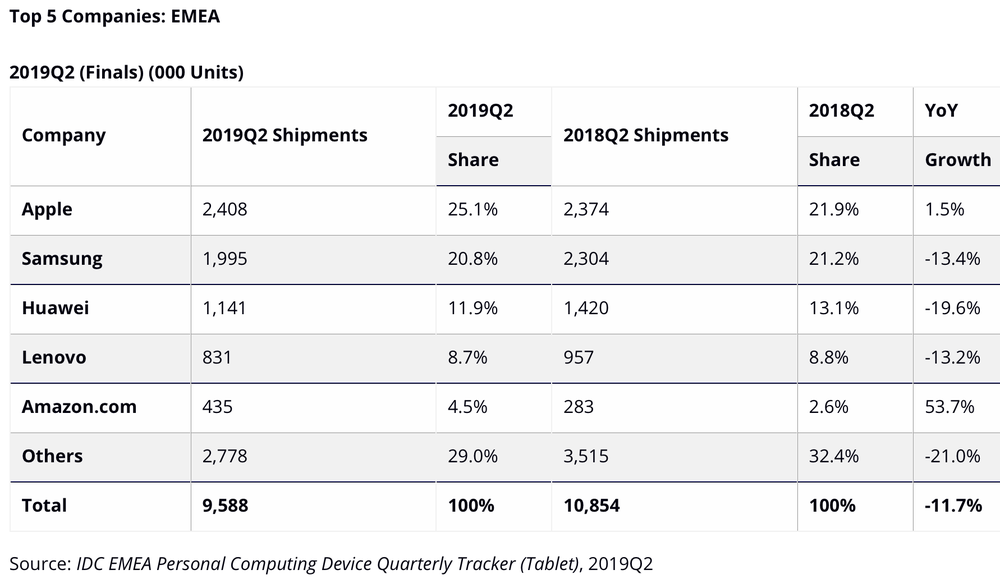

According to the latest figures published by IDC, the overall EMEA [Europe, Middle East, and Africa) tablet market declined 11.7% year-over-year, shipping 9.6 million units in the second quarter of 2019. Apple retained market leadership in EMEA, with the help of a buoyant detachable quarter and the resurrection of the iPad mini.

IDC says the ongoing erosion of consumer demand for slate tablets remains the primary reason for the contraction, and a lack of innovative features and the increasing range of devices in the market are inhibiting tablet renewal. The good news for quarter two, however, is the strong performance of detachables, which increased 11.8% after two years of consecutive quarterly declines.

“The expectation of a detachable rebound in the market was finally realized in Q2 and on a bigger scale than anticipated,” says Daniel Goncalves, senior research analyst, IDC Western European Personal Computing Devices. “This was mainly driven by shipment pull-in of the freshly released iPad Air, a budget alternative to the iPad Pro and a contender to the Surface Go in the midrange tablet market with keyboard capabilities that have the potential to become a back-to-school winner.”

The overall tablet market in Western Europe declined 6.6% year-over-year in quarter two, while Central and Eastern Europe, the Middle East, and Africa (CEMA) declined 18.7%.

“As content consumption tasks performed by consumers have moved to bigger screen size smartphones, 7in. and 8in. tablets become less relevant,” says Nikolina Jurisic, product manager, IDC CEMA.

The EMEA tablet market is forecast to decline by 7.4% in the third quarter of the year and by 9.9% for overall 2019, maintaining the trend seen in recent years. Detachables and the commercial segment, however, are expected to partially offset the decline in slates in consumer.

“The second half of 2019 will remain inhibited as slates continue to decline across regions,” says Jurisic. “In comparison, detachables are expected to perform slightly better. The economic revival, stronger consumer and commercial confidence, and new and attractively priced products are expected to positively influence the market.”

The adoption of tablets in the commercial segment is expected to grow from 2020, driven primarily by detachables, as slates will remain relatively stable.

“In 2019, we expect to see a return to growth for detachables in enterprise and a jump from 2020 with double-digit growth,” says Goncalves. “The good performance in Q2 might just be the beginning, as the workforce becomes increasingly mobile and the increase in the Windows 10 installed base contributes to the expansion of ultraportable systems.”

Tablets are expected to increase at a compound annual growth rate of 4.7% in the commercial segment from 2019 to 2023.