In a note to clients — as noted by Barron’s — HSBC, a British multinational banking and financial services holding company (and the seventh largest bank in the world) says Apple’s upcoming credit card, the Apple Card, could become a “significant player in the U.S. card market,” HSBC says in new note.

HSBC’s Nigel Fletcher its optimistic about the “large potential captive target market,” that could ultimately see half of Apple’s 146 million-strong adult installed U.S. user base adopt the card in the coming years. By the Apple Card’s fifth year, Fletcher believes that outstanding balances could be more than $50 billion, high enough that the card would be among the nation’s top-10 largest U.S. credit card providers.

He’s estimating potential net income of $300 million the first year, climbing to $1.5 billion by year five. Assuming a revenue split of 70%/30% for Goldman Sachs and Apple, then by the second year, “Goldman Sachs’ share of profit before tax would be $500 million.

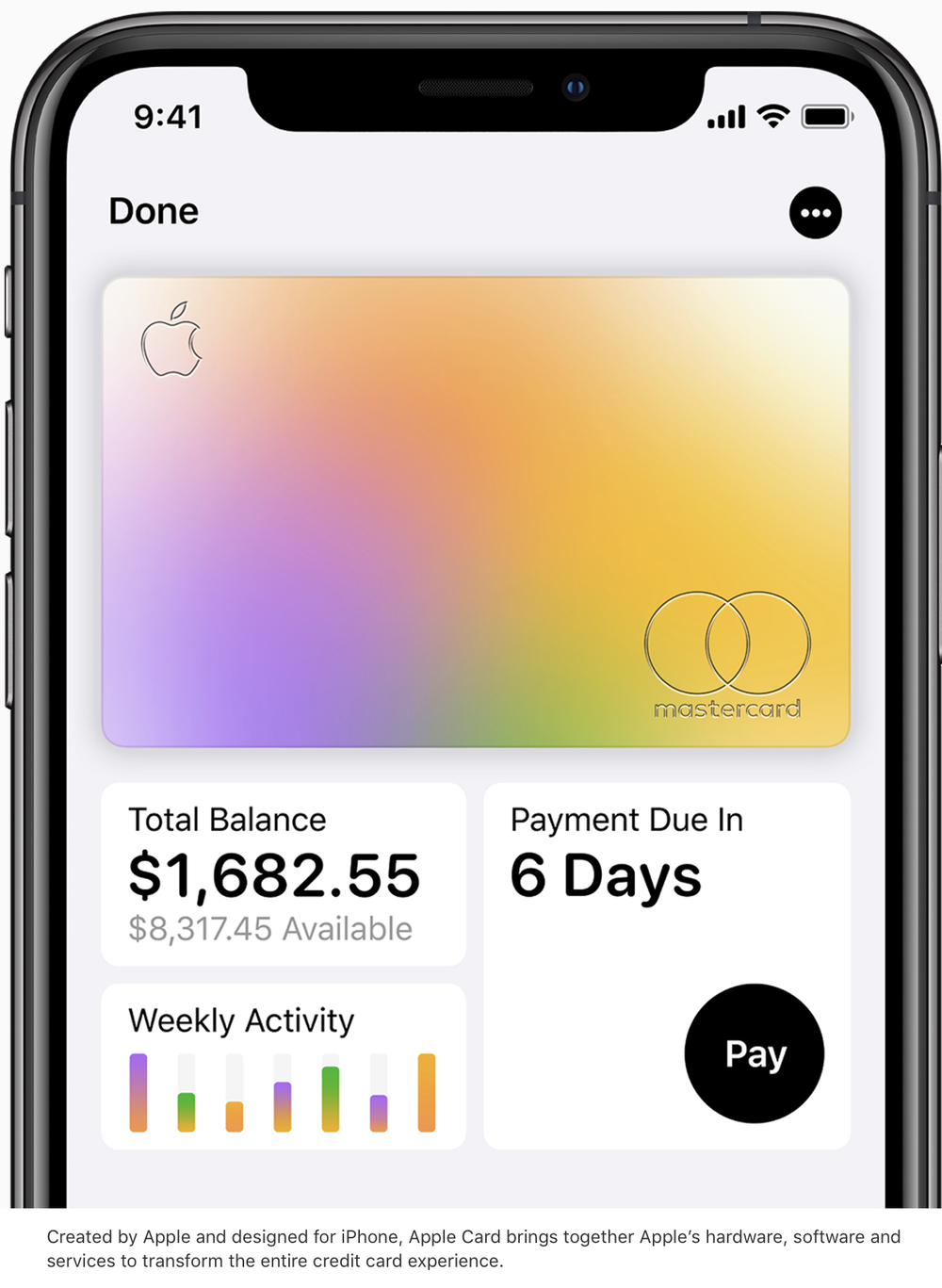

Coming this summer, the Apple Card will be built into the Apple Wallet app on the iPhone, allowing customers to manage their card right on the smartphone.