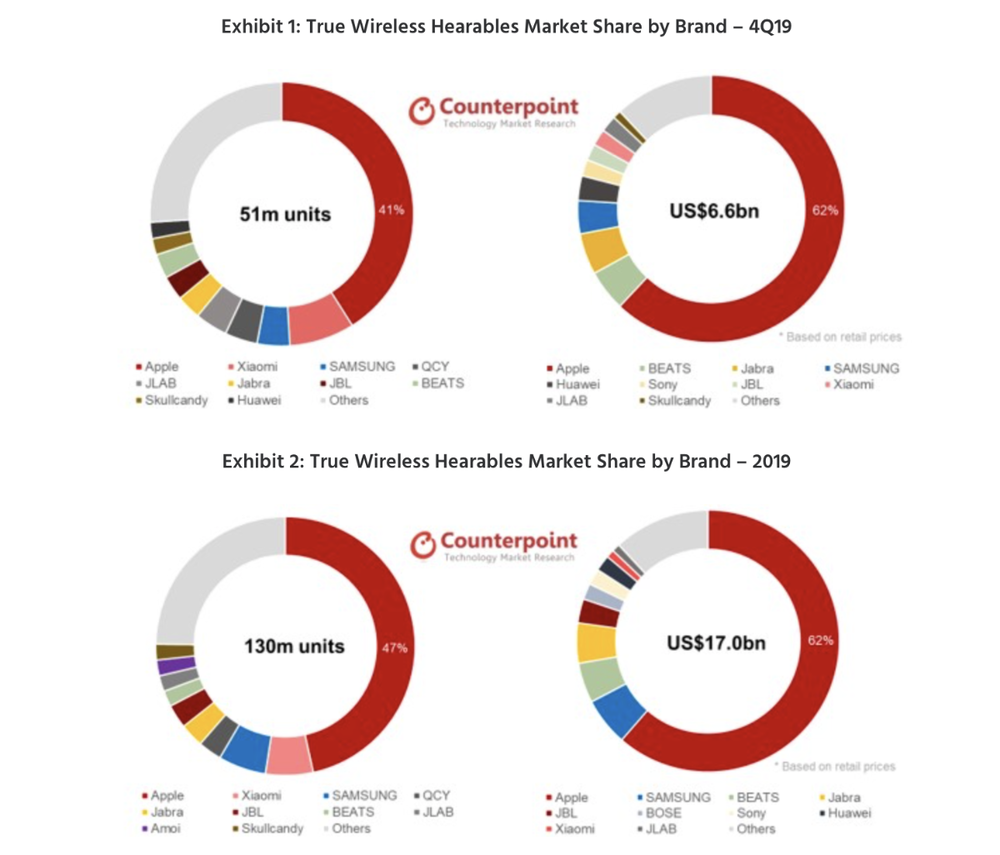

The global market size for true wireless hearables beat expectations, growing 53% quarter-over-quarter [QoQ] in the fourth quarter of 2019, topping 51 million units for the quarter and 130m units for the full year, according to Counterpoint Research’s latest Hearables Market Tracker. The U.S. was the main driver for the quarter, growing 76% QoQ and accounting for 35% of the global market on the back of seasonal promotions and Apple’s new model launch.

The launch of Apple’s new AirPods Pro model in late October helped the company record steady 44% growth in quarter four of 2019, with six million units sold despite supply shortages. Apple’s market share fell slightly to 41% QoQ as it attempted to keep up with swift overall market growth; market share for the full year reached 47%,

Xiaomi kept its second-place spot in the quarter supported by strong sales of its Redmi Airdots, followed by Samsung, QCY and JLab. The race for second intensified, with both Xiaomi and Samsung holding around 6% unit market share for the year

The US$100-and-above segment saw Apple, Samsung and Jabra accounting for more than 80% of quarter four 2019 sales as demand surged in developed countries to see overall quarterly growth of 66%. The sub-US$100 band, driven mainly by U.S. and Chinese brands, was more fragmented, with the top three accounting for only a third of the overall pie

“We expect Apple to sell more than 100m true wireless hearables in 2020, including AirPods Pros, to maintain their comfortable lead in the market,” says Liz Lee, senior Aanalyst at Counterpoint Research. “The real competition will be for second place, especially in the premium market; Samsung, which sold 8m Galaxy Buds last year, will need further upgrades to those expected in the Galaxy Buds Plus, including noise cancellation and other advanced features and designs, in order to beat its rivals.”