A new forecast from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker shows signs of market recovery in the second half of 2019 and into 2020, pushing smartphone shipment growth back into positive territory.

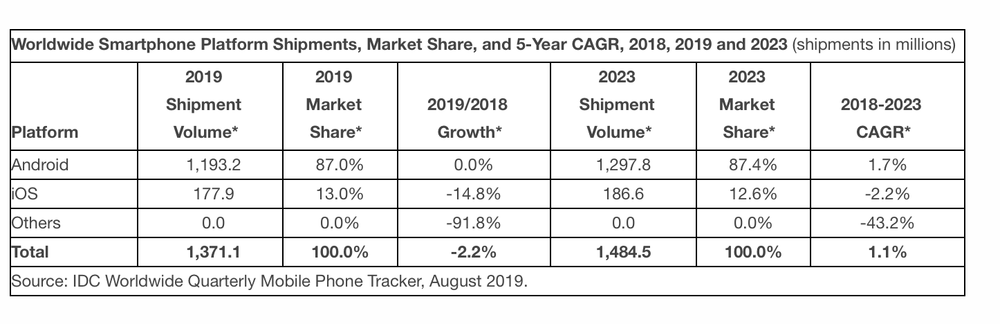

The research expects shipment volumes to be nearly flat (-0.4%) in the second half of 2019 while the market declines 2.2% year-over-year for the full year, making 2019 the third straight year of global contraction. IDC expects shipment growth to reach 1.6% in 2020.

“The global smartphone market and relevant supply chains remain uncertain, largely due to fluctuations in U.S-China trade negotiations, making future planning even more challenging than normal,” says Sangeetika Srivastava, senior research analyst with IDC’s Worldwide Mobile Device Trackers. “Consumers continue to hold their devices for lengthier times making sales difficult for the vendors and channels alike. However, expectations of aggressive promotions and offers in the second half of 2019 aimed at helping to clear out any channel inventory and get consumers excited about the next wave of smartphone technology should steer the market back toward renewed growth.”

While global economic uncertainty mixed with constant trade/tariff threats continues to dominate headlines, a ray of hope has arrived for the smartphone world in the form of 5G, he adds. Commercial deployments have begun in many regions and while 2019 is very much an introductory year at best, 2020 looks to be the year where 5G begins to ramp up.

IDC expects 5G shipments to reach 8.9% of smartphones shipped in 2020, accounting for 123.5 million devices shipped. This is expected to grow to 28.1% of worldwide smartphone shipments by 2023.

“The anticipation of 5G, beginning with smartphones, has been building for quite some time but the challenges within the smartphone market over the past three years have magnified that anticipation,” says Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “To be clear, we don’t think 5G will be the savior in smartphones, but we do see it as a critical evolution in mobile technology. We expect the 5G ramp on smartphones to be more subtle than what we saw with 4G, but that is primarily because we are in a much different market today.”

The biggest difference is the level of penetration we are at now compared to 2010/2011, specifically in China, the U.S., and Western Europe. The biggest change in the IDC 5G forecast assumptions is that the research group has lowered average selling prices (ASPs), particularly in China.

“We also expect a wide range of sub-6GHz 5G smartphones with midrange prices to enter the market in early 2020, if not sooner,” Reith says.

He adds that 2019 will remain a challenging year for iPhone shipments with volumes expected to drop to 177.9 million, down 14.8% year-over-year, mostly due to market maturity as well as a lack of 5G devices. However, Apple is likely to deliver 5G handsets later in 2020, which will pick up iOS volumes slightly as it will have an edge over other vendors with a better understanding of 5G market conditions for a much more planned launch.