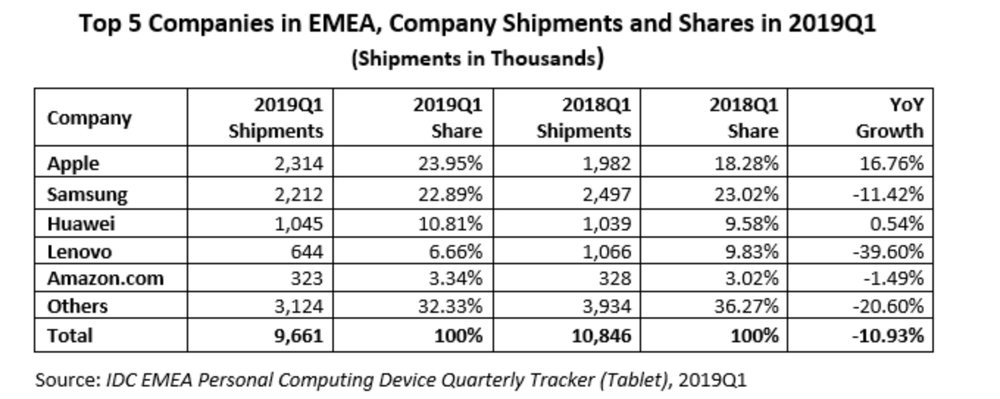

According to the latest figures published by IDC, the overall tablet market in EMEA [Europe, the Middle East and Africa] declined 10.9% year-over-year [YoY], shipping 9.7 million units in the first quarter of 2019.

Demand remains weak in the consumer segment as the lack of compelling reasons for consumers to refresh their tablets has slowed the pace of device renewals. Apple emerged as the clear winner in the first quarter, regaining the number one position in EMEA, with an impressive run of six consecutive positive YoY quarter performances in the declining market.

According to IDC, the commercial segment continues to consistently outperform the market average. It only represents around a fifth of the overall market in EMEA, however, so its growth in the first quarter of 2019 didn’t offset the decline in the consumer space.

“The proliferation of use cases across multiple key industries such as the financial sector, retail, transportation, and education is creating very interesting pockets of growth for tablet devices,” says Daniel Goncalves, senior research analyst, IDC Western European Personal Computing Devices. “As the erosion of the consumer space shows no signs of slowing down, enterprise is the only real opportunity for growth, so cooperation with vertical-specific resellers and the creation of scalable end-to-end solutions are vital.”

Overall, the tablet market in Western Europe declined 7.7% YoY in quarter one of 2019, while Central and Eastern Europe, the Middle East, and Africa (CEMA) declined 15.8% YoY.

“While consumer demand in the CEE region remained in negative territory during the first quarter of 2019, the commercial segment increased by double digits as it benefitted from significant deliveries to the telco and banking sectors in Poland,” says Nikolina Jurisic, product manager, IDC CEMA.