Think you’re clever for using Apple products? You’re right! A new study says we have higher credit scores, loan amounts and better rates than Android and Windows users.

LendingTree, an online loan marketplace, analyzed over two million purchase mortgage and personal loan requests to better understand how Americans are shopping for their loans. The findings show that 41% of purchase mortgage shoppers and almost half (48.53%) of personal loan shoppers use a mobile device to shop and compare loan offers from different lenders. Additionally, the analysis suggests a correlation between a user’s device, credit score, and loan amount.

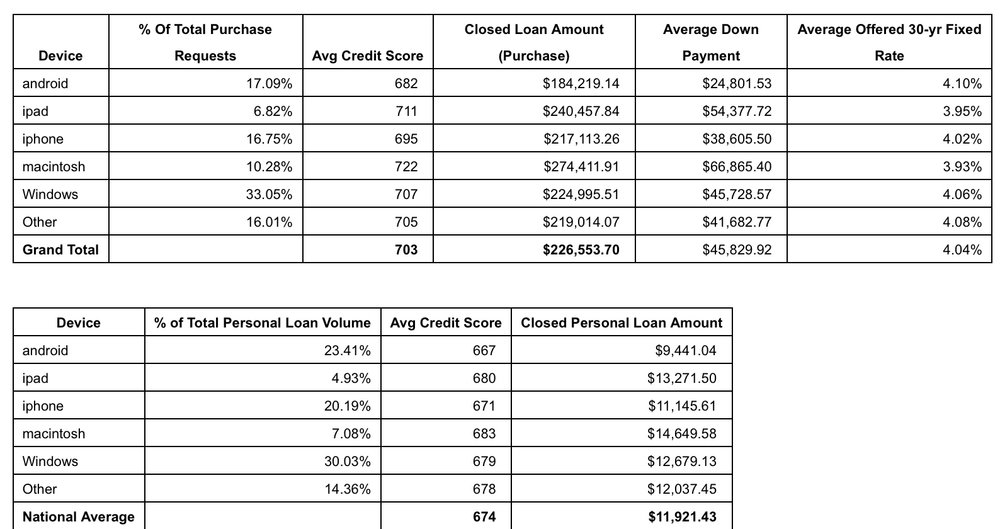

Overall, potential borrowers using a Mac have the highest average credit score in both the mortgage (FICO average 722) and personal loan (FICO average 683) categories, along with the highest average loan amount in each. In 2016, the average loan amount for Mac users was $274,412 for a mortgage and $14,650 for a personal loan, much higher than the national average of $226,554 and $11,921, respectively. The average down payment amount for borrowers using a Mac in 2016 was $66,865 while the national average came in at approximately $45,830.

Because Mac users averaged higher credit scores, they also received a lower interest rate offer on a 30-year fixed rate mortgage loan. Although interest rates increased in the last few weeks of 2016, the national average 30-year fixed interest rate for 2016 was roughly 4.04% when Mac users, with a higher average credit score, where offered an average rate of 3.93%.

Following closely behind Mac users are Apple iPad users, averaging the second-highest credit score and second-highest loan amount in both mortgage and personal loan categories, despite being one of the least-common devices used to submit loan requests. Naturally, iPad users received the second-lowest interest rate offer for a 30-year fixed rate mortgage loan, 3.95% in 2016.

On the other side of the spectrum, Android users averaged the lowest credit scores and lowest loan amounts in both the mortgage and personal loan categories. Unfortunately, this also means average interest rates offered to Android users were higher than the national average.

“The disparity in loan details between Mac and Android users is most likely a reflection of different price points and the affordability of the respective devices. Regardless of the device type, we’re thrilled to see a substantial portion of loan requests coming from mobile users as we continue to enhance our mobile experience and applications for consumers who are exploring finance options,” says Doug Lebda, founder and CEO of LendingTree.

Data was analyzed from over 2 million loan requests and funded loans facilitated by LendingTree and through My LendingTree between January 1 and December 31, 2016. My LendingTree is LendingTree’s financial intelligence platform, which “analyzes consumers’ financial health to identify savings opportunities, provides a free monthly credit score and offers ongoing advice for credit improvement.”