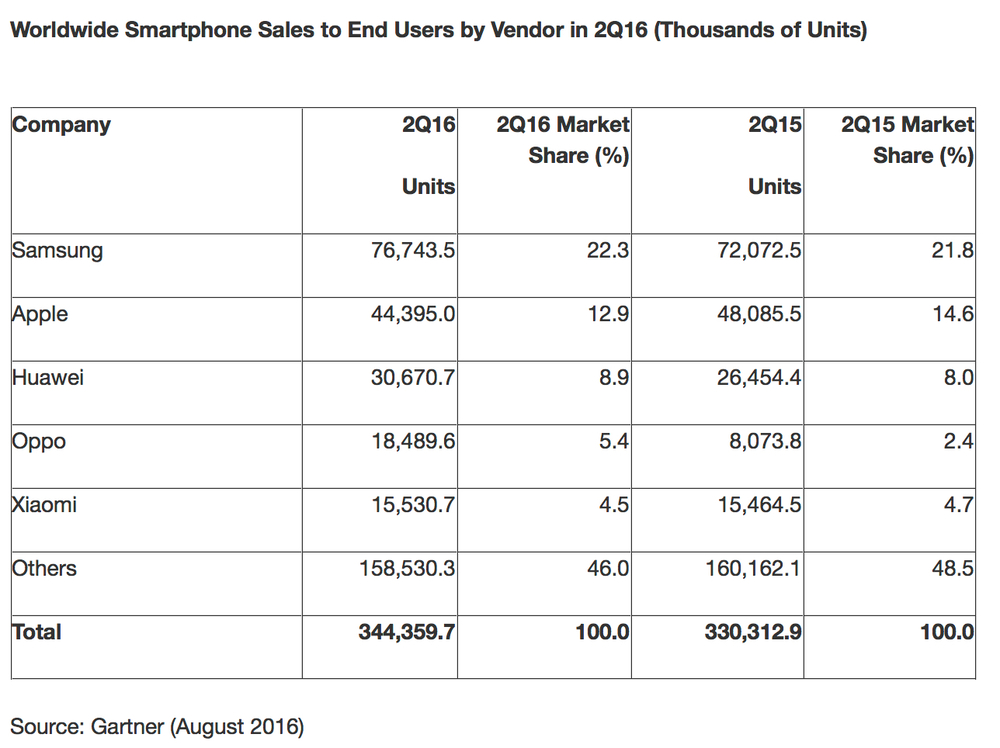

Global sales of smartphones to end users totaled 344 million units in the second quarter of 2016, a 4.3% increase over the same period in 2015, according to Gartner, Inc. However, the second quarter was Apple’s third consecutive one of slowing iPhone demand. That should pick up with the introduction of the “iPhone 7,” according to the Sellers Research Firm (that’s me).

Overall sales of mobile phones contracted by 0.5% with only five vendors from the top 10 showing growth. Among them were four Chinese manufacturers (Huawei, Oppo, Xiaomi and BBK Communication Equipment) and South Korea’s Samsung.

All mature markets except Japan saw slowing demand for smartphones leading to a decline in sales of 4.9%. In contrast, all emerging regions except Latin America saw growth, which led to smartphone sales growing by 9.9%.

In the second quarter of 2016, Samsung had nearly 10% more market share than Apple. Samsung saw sales of its Galaxy A and Galaxy J series smartphones compete strongly with Chinese manufacturers. Its new smartphone portfolio also helped Samsung win back share it recently lost in emerging markets.

Apple continued its downward trend with a decline of 7.7% in the second quarter of 2016. Apple sales declined in North America (its biggest market) as well as in Western Europe. However, it witnessed its worst sales decline in Greater China and mature Asia/Pacific regions, where sales declined 26 percent. Apple had its best performance in Eurasia, Sub-Saharan Africa and Eastern Europe regions in the second quarter of 2016, where iPhone sales grew more than 95 percent year on year.

Among the top five smartphone vendors, Oppo exhibited the highest growth in the second quarter of 2016 at 129% This is due to strong sales of its R9 handset in China and overseas.

In terms of the smartphone operating system (OS) market, Android regained share over iOSto achieve an 86% share in the second quarter of 2016. Android’s performance continued to come from demand for mid- to lower-end smartphones from emerging markets, but also from premium smartphones, which recorded a 6.5% increase in the second quarter of 2016, according to Gartner.