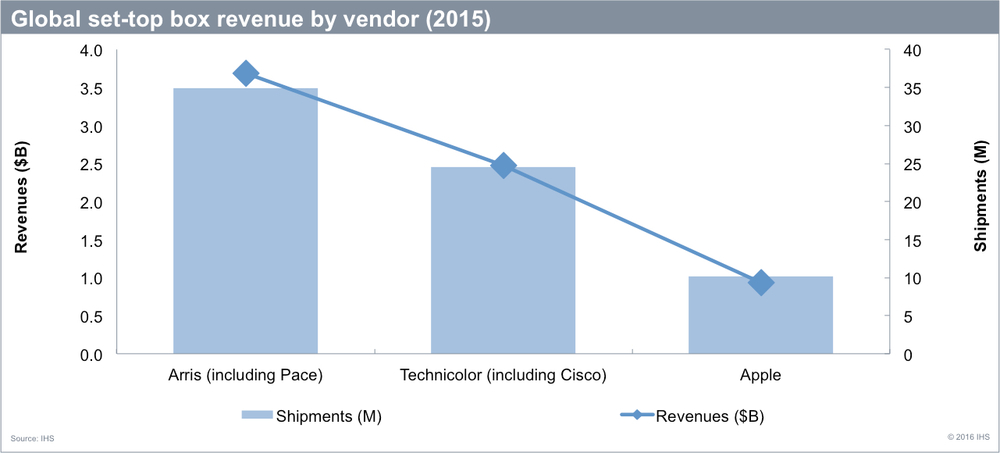

Okay, let’s quit calling it a hobby. Apple TV sales have propelled Apple into third place for global set-top box popularity in 2015, based on revenue, according to IHS, Inc. That’s up from ninth place in 2014, according to the research group.

The surge is courtesy of continued strong growth in consumer retail over-the-top television (OTT) boxes, and the consolidation of the top players of the global set-top box market with Arris’s acquisition of Pace and Technicolor’s acquisition of Cisco’s set-top box division, which were finalized last year. Bringing Apple into global contention from a unit-shipment standpoint, more than 10 million Apple TVs were shipped in 2015 — the fifth largest volume in the world — following Arris, Technicolor, and Skyworth and ZTE, according to IHS, Inc.

“The STB market has certainly grown since 2007, when Steve Jobs originally described the Apple TV business line as a ‘hobby,’” says Daniel Simmons, director of connected home for IHS Technology. “Now we’re seeing sales of Apple’s consumer devices in the millions, which has catapulted the company ahead of leading STB manufacturers that ship to pay-TV providers. Apple TV’s particular success is a result of translating consumption habits from across Apple’s wider device ecosystem onto the TV screen.”

In 2015, global set-top box shipments grew 4.8 percent, year over year, to reach 353 million units, according to the IHS Set-Top Box Intelligence Market Monitor. This growth was driven by internet-protocol television (IPTV) in China, where telecommunications companies are pushing IPTV services to generate returns on their investments in fiber to the home (FTTH), which connects buildings with high-speed internet access.

Revenue increased by 3.4% to reach $5.7 billion in the fourth quarter of 2015, compared to the previous quarter, partially driven by next generation device launches of Apple, Amazon, and Roku. Revenue for 2015 fell 5.4% to $22.2 billion, due to reduced demand for high value STBs in North America, primarily caused by poor pay-TV performance in the region.

“The new positioning of Apple at the top of the set-top box market reflects several trends,” Simmons says. “Pay-TV specific set-top boxes are becoming less important for consumers to access premium content, because Netflix, HBO Go and other OTT [over-the-top] video platforms now offer top-tier content to retail OTT STBs. As retail STBs have grown in the market, traditional pay-TV set-top vendors have been forced to re-position themselves, with significant consolidation at the top of the market, diversification toward software and services in the middle, and low-end vendors moving toward broader volume.”

Protect your Apple Watch from scratches with the X-Doria Revel for 42 mm Apple Watch