For the first time, a generic mobile payment app is more popular than the Starbucks mobile app, which had long led the category despite being specific to one retailer. Apple Pay became the market leader last year, when 27.7 million Americans used the app to make a purchase, according to eMarketer.

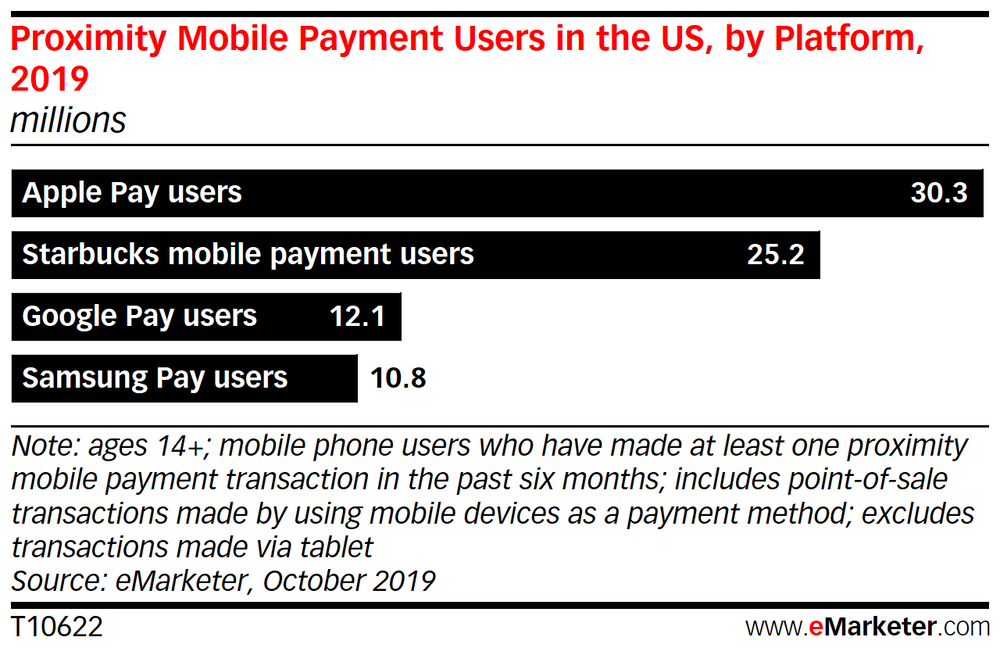

Since the research group’s last mobile payments forecast in May 2018, Apple Pay use has grown even faster than expected. In 2019, Apple Pay will have 30.3 million users in the U.S., representing 47.3% of proximity mobile payment users. Following closely behind, the Starbucks app will have 25.2 million users this year, representing 39.4% of proximity mobile payment users.

“Apple Pay has benefited from the spread of new point-of-sale (POS) systems that work with the NFC signals Apple Pay runs on,” says eMarketer principal analyst Yory Wurmser. “The same trend should also help Google Pay and Samsung Pay, but they will continue to split the Android market.”

Technology for proximity mobile payments is gaining traction, especially at frequently used retailers like grocery stores. According to Digital Trends, Apple Pay is expected to be available in 70% of U.S. retailers by the end of 2019. The strong uptake prompted eMarketer to revise its figures upward. And while the Starbucks app has enjoyed around a 40% market share of mobile payments users for a few years, its growth potential is more limited since it can only be used at Starbucks stores, according to the research group.

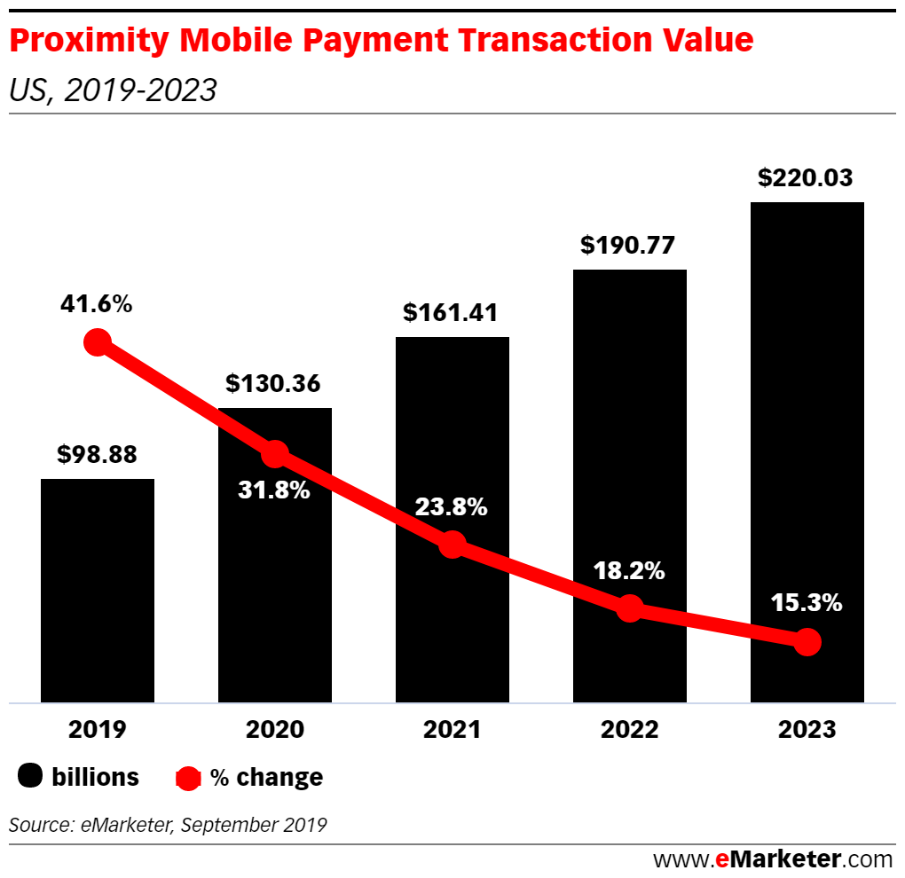

Total spending via proximity mobile payments will approach $100 billion this year in the U.S. That means that on average, a user will spend $1,545 per year using proximity mobile payments, up more than 24% over last year.

Overall, the total number of people using proximity mobile payments in the U.S. this year will grow 9.1% to 64.0 million, according to eMarketer. That represents nearly 30% of all U.S. smartphone users.

“With in-store payments, there is a need for convenience that proximity payments are increasingly fulfilling,” says eMarketer junior forecasting analyst Vincent Yip. “Although a growing number of millennials feel secure using payment apps, virtually all still find credit and debit cards equally convenient.”

Although the use of proximity mobile payments is growing among all age groups, U.S. adults ages 25 to 34 are the largest demographic in terms of absolute size and penetration, with 21.2 million users, or nearly 50% of all smartphone users in this age group. The fastest growth is among Americans ages 55 to 64 but from a small base.