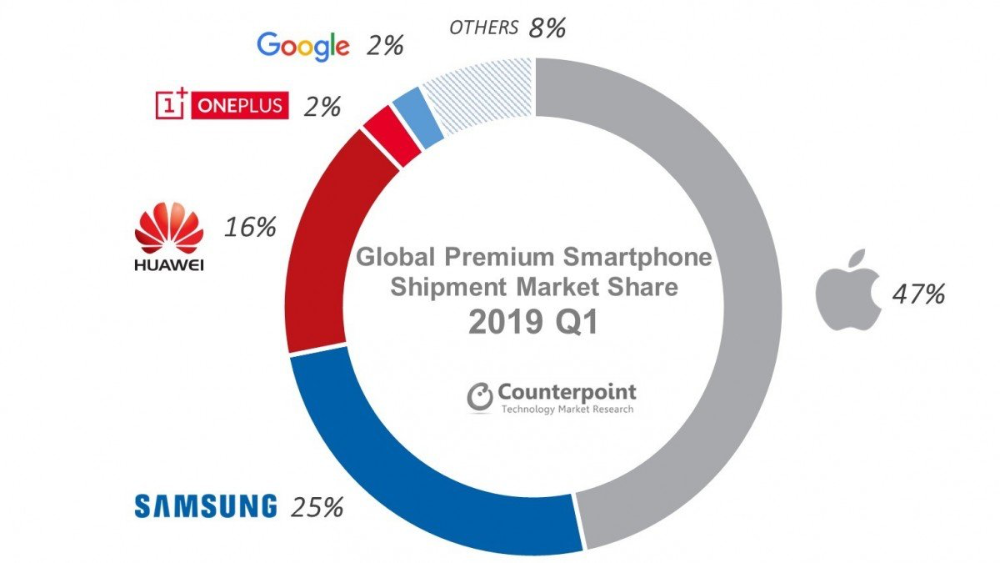

Apple still leads the global premium smartphone market, but the company’s declining shipments has pulled down the global smartphone premium segment. Data from Counterpoint Research’s Market Monitor Service for quarter one (Q1) of 2019, shows that Apple’s shipments fell 20% year-on-year in Q1 2019, resulting in an 8% year-over-year decline for the global premium segment ($400 and higher).

However, as Apple is losing ground, Samsung is gaining share. During the quarter, Samsung ended up with one-fourth of the global premium segment, its highest ever share over the past year. This was also the first time when Samsung launched three devices instead of the usual two in its S series, thus covering wider price points.

According to Counterpoint’s analysis, the trend of users holding onto their iPhones for longer has affected Apple’s shipments. The replacement cycle for iPhones has grown to over three years, on an average, from two years. On the other hand, substantial design changes in the Galaxy S10 series and the better value proposition it offers compared to high-end iPhones helped Samsung close the gap to Apple in the global premium segment, adds the research group.

Apart from Apple’s falling shipments, the sluggishness of the Chinese market was the other key reason for the decline in the global premium segment. Counterpoint’s estimates suggest that almost half of the decline in the global premium segment in Q1 2019 was due to the sluggish Chinese market. However, the research group expects that as 5G begins to commercialize in the future, the premium segment will grow. In 2019 and 2020, all the 5G devices are expected to launch in the premium segment.