Consumer Intelligence Research Partners (CIRP) has released results from its research on smart speakers, including Apple’s HomePod, Amazon’s Echo, and Google’s Home.

CIRP analysis indicates that Apple’s speaker has a 6% share of the U.S. installed base of smart speakers as of June 30. Across the market, consumers migrated to the lowest-priced models. For the two biggest competitors, Echo Dot accounts for over half of the Amazon Echo installed base, and Home mini is about 40% of the Google Home installed base.

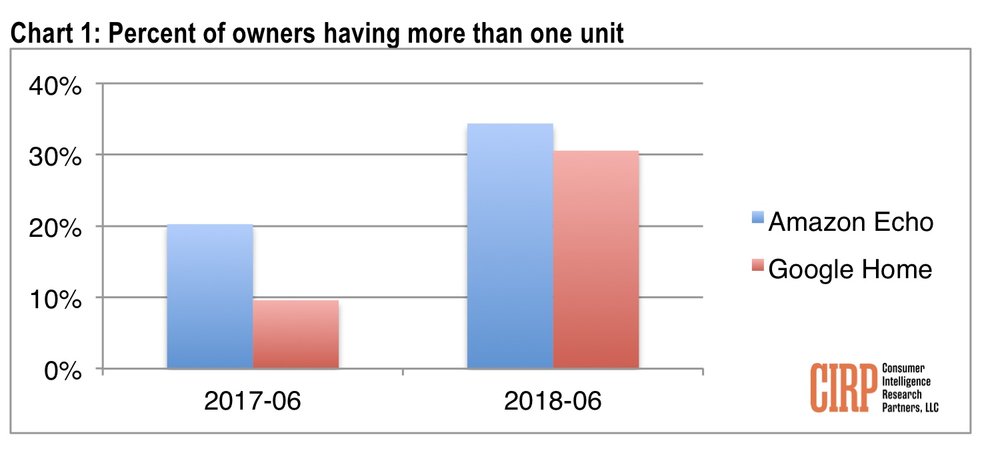

Because of this shift, Amazon and Google have not only sold more total smart speakers, they’ve also encouraged individual consumers to own more units and integrate their respective platforms into their households. About one-third of Echo and Home users own more than one unit, according to CIRP.

“Apple famously prices above, and sometimes far above, similar products,” says Josh Lowitz, partner and co-founder of CIRP. “In this case, HomePod costs much more than available Amazon Echo and Google Home models. With low-priced entry-level models, Amazon and Google clearly seek to become the operating system of choice and capture customers for the long-term. Can Apple capture homes with only a high-end smart speaker, and ignore competitors? Last week Apple announced software improvements to the single HomePod model, features that Echo and Home added months ago, but there is little time for Apple to release a competitive model for Christmas 2018.”

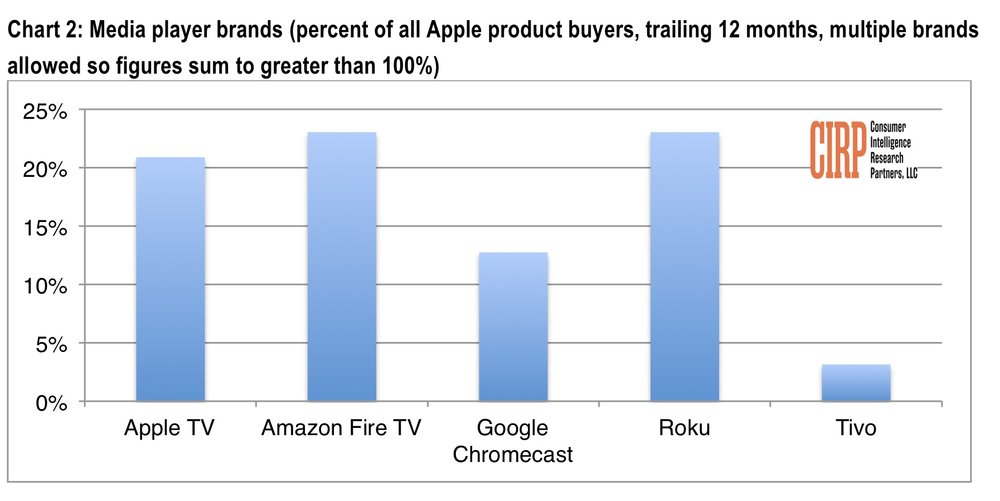

For comparison, CIRP analyzed Apple’s other home device, its Apple TV media player. Among Apple customers, almost two-thirds have a media player, compared to the one- third have a smart speaker. For Apple customers that own a media player, Apple TV is the third most popular brand, capturing 20% of that group.

“The streaming media player market is at least as competitive as the smart speaker market,” says Mike Levin, partner and co-founder of CIRP. “After starting high, Apple now offers Apple TV models priced closer to competitors than it prices HomePod. With this pricing, Apple did penetrate its customer base. In contrast, the more expensive HomePod has barely done so. Only 2% of Apple customers have a HomePod as of the June 2018 quarter, with Amazon Echo and Google Home having far greater shares.”

CIRP bases its findings on its quarterly surveys of Apple customers and smart speaker buyers, for the five quarters ending June 2018.