Apple’s share of the $600-plus Chinese smartphone market is 80%, according to new data from Counterpoint Research.

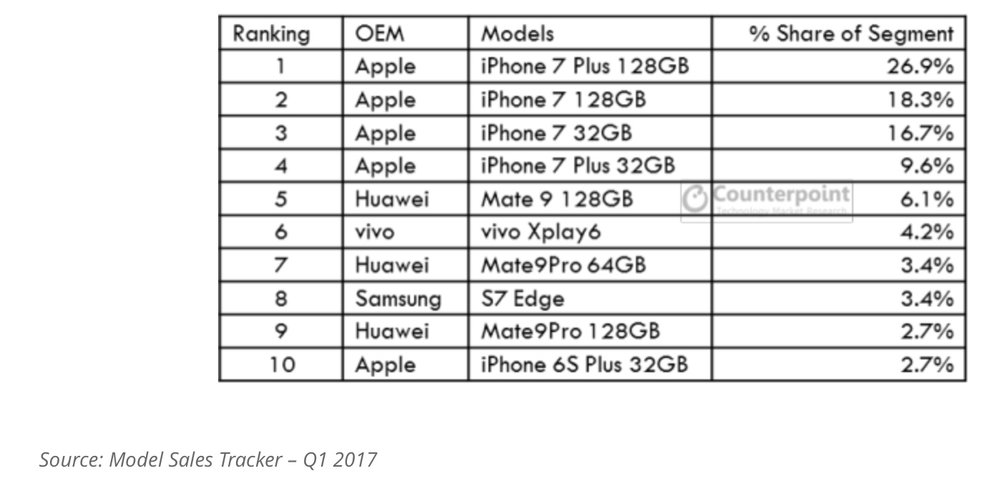

“The premium segment $600+ or 4000rmb remained flat annually but shrunk 33% sequentially. Apple’s share of this super-premium segment remains at 80%, with five out of the top ten model SKUs belonging to Apple,” says Research Analyst Mengmeng Zhang. “The 4000 rmb and above segment mostly peaks during the Apple iPhone launch quarter and shrinks for the rest of the year. This volatility is because of Apple and affects Apple, as competition in the premium space is still weak. Though we are seeing Huawei with its Mate 9 series and players such as Vivo trying to make some movement in this segment to attract premium Android users.

Smartphones shipments in China grew a modest 4% annually during Q1 the first quarter of 2017 and declined 20% sequentially. Oppo and vivo were the fastest growing brands followed by Huawei, together cementing the top three spots and extending their lead over Apple, Xiaomi and Samsung by a widening margin. Apple’s performance has become very seasonal, while Xiaomi and Samsung are losing to Huawei (Honor) and the Oppo-Vivo onslaught, respectively, says Zhang.