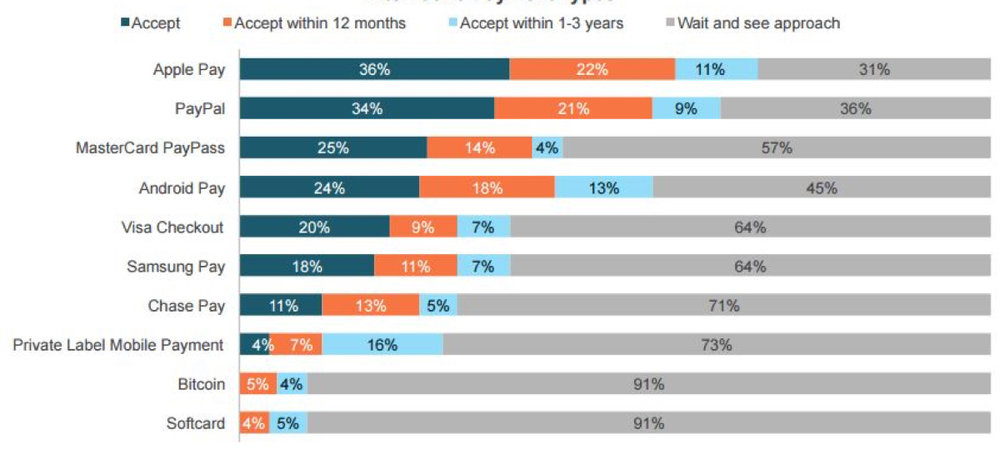

Apple Pay has the largest percentage of supporting U.S. merchants with 36% accepting Apple’s mobile payment service, according to new data from Boston Retail Partners (BRP) That’s up from 16% in 2016.

Approximately 22% of retailers are planning to accept Apple Pay in the next 12 months, 11% plan to do so within 1-3 years, and 31% are adopting a “wait and see” approach. PayPal is in second place with a 34% acceptance rate, followed by Mastercard PayPass (25%), Android Pay (24%), Visa Checkout (20%), Samsung Pay (18%), Chase Pay (11%) and private label mobile wallets with 4%

Almost half (49%) of retailers already are using mobile solutions for sales staff, up from fewer than a third (31%) last year, according to BRP. The study comprised a survey of 500 top North American retailers, 76% of which have revenue of $100 million or more and 50% with revenue of $500 million or more.

Apple Pay is currently available in 13 countries: Australia, Canada, China, France, Hong Kong, Japan, New Zealand, Russia, Singapore, Spain, Switzerland, the UK and USA. Apple Pay works with iPhone 6s, iPhone 6s Plus, iPhone 6, iPhone 6 Plus and Apple Watch. When paying within apps, Apple Pay is compatible with the iPhone 6s, iPhone 6s Plus, iPhone 6, iPhone 6 Plus, iPad Air 2, iPad mini 3, iPad mini 4 and iPad Pro. It also works in macOS Sierra.