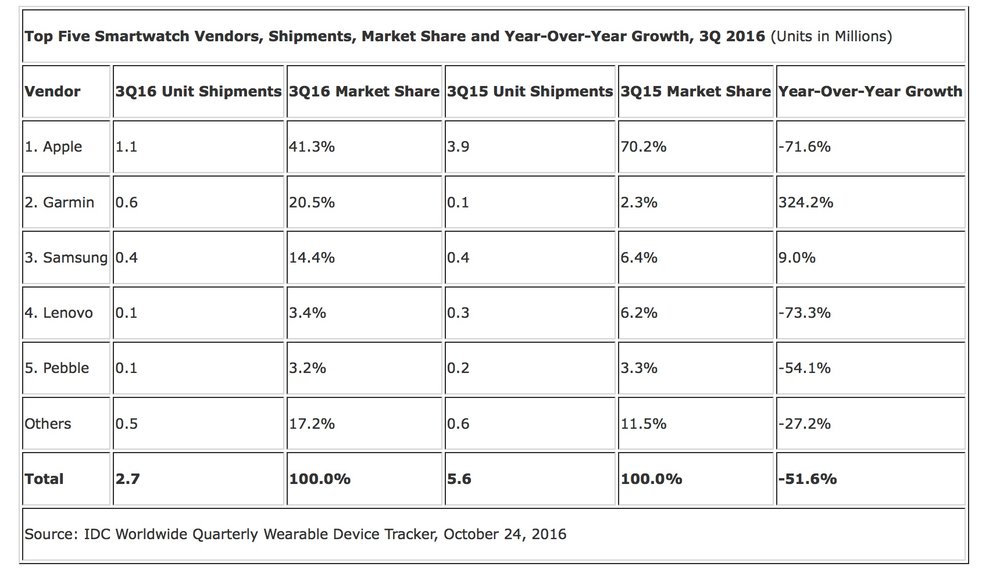

Apple remains the top global smartphone vendor despite a steep decline in sales. In fact, the worldwide smartwatch market saw a year-over-year decline in shipment volumes.

According to data from the International Data Corporation, (IDC) Worldwide Quarterly Wearable Device Tracker, total smartwatch volumes reached 2.7 million units shipped in 3Q16, a decrease of 51.6% from the 5.6 million units shipped in 3Q15. Although the decline is significant, it is worth noting that the third quarter of 2015 (3Q15) was the first time Apple’s Watch had widespread retail availability after a limited online launch. Meanwhile, the second generation Apple Watch was only available in the last two weeks of 3Q16.

“The sharp decline in smartwatch shipment volumes reflects the way platforms and vendors are realigning,” says Ramon Llamas, research manager for IDC’s Wearables team. “Apple revealed a new look and feel to watchOS that did not arrive until the launch of the second generation watch at the end of September. Google’s decision to hold back Android Wear 2.0 has repercussions for its OEM partners as to whether to launch devices before or after the holidays. Samsung’s Gear S3, announced at IFA in September, has yet to be released. Collectively, this left vendors relying on older, aging devices to satisfy customers.”

“It has also become evident that at present smartwatches are not for everyone,” adds Jitesh Ubrani senior research analyst for IDC Mobile Device Trackers. “Having a clear purpose and use case is paramount, hence many vendors are focusing on fitness due to its simplicity. However, moving forward, differentiating the experience of a smartwatch from the smartphone will be key and we’re starting to see early signs of this as cellular integration is rising and as the commercial audience begins to pilot these devices.”

Apple maintained its position as the overall leader of the worldwide smartwatch market, yet it posted the second largest year-over-year decline among the leading vendors. Its first-generation Watches accounted for the majority of volumes during the quarter, leading to the significant downturn for the quarter. Its Series One and Series Two did little to stem that decline, although with lower price points and improved experiences, Apple could be heading for a sequential rebound in 4Q16, says IDC.