Apple has been granted a patent (number 201602755475) for “group peer-to-peer financial transactions.” With macOS Sierra, Mac users can now pay online in Safari using a “Pay with Apple Pay” button, and authenticate their purchase using Touch ID on their phone or watch. Soon owners of iOS and macOS devices may be able to easily send electronic cash to each other.

In the patent filing, Apple notes that, as we move to a more mobile and fast-paced society, the use of cash or currency is being increasingly replaced by electronic transactions using credit cards, debit cards, etc. It’s pretty common for consumers to hold multiple non-currency accounts concurrently (e.g., multiple credit cards or debits cards corresponding to a respective banking provider), each of which may be dedicated for a particular type of purchase or financial exchange.

For example, a consumer may concurrently hold a credit card account that may be dedicated for gas or automotive purchases, a credit card account specifically for travel-related purchases, a general purpose credit card account for miscellaneous purchases, as well as one or more loyalty credit card accounts that may be used only with specific retailers or vendors. In addition, the consumer may also hold, concurrently, one or more debit card accounts associated with respective banking providers.

The consumer may make payments or participate in financial exchanges using any of the above-discussed accounts by way of a payment instrument representing the account, such as a credit card. As the number of payment accounts held by the consumer increases, however, it may become increasingly inconvenient to carry such a large number of credit/debit cards. Further, while payments made using the above-discussed accounts may be readily compatible with retailer and vendor businesses, including those established online on the Internet, payments made from these accounts may not always be readily accepted by other consumers or “peers.”

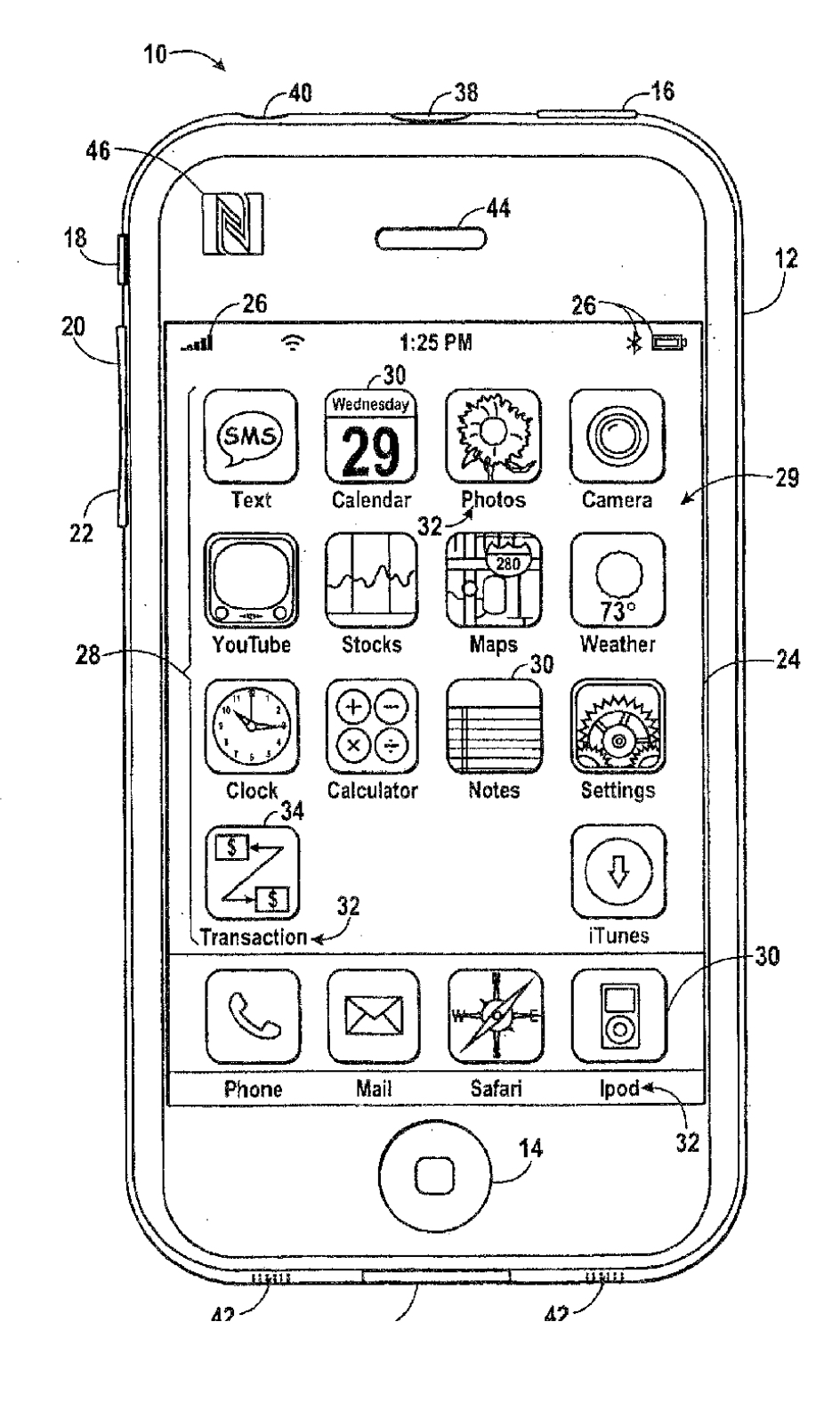

In one embodiment, a request for payment is transmitted from an Apple iOS or macOS device to a second device using a near field communication (NFC) interface. In response to the request, the second device may transmit payment information to the first device. The first device may select a crediting account and, using a suitable communication protocol, may communicate the received payment information and selected crediting account to one or more external financial servers configured to process and determine whether the payment may be authorized.

If the payment is authorized, a payment may be credited to the selected crediting account. In a further embodiment, a device may include a camera configured to obtain an image of a payment instrument. The device may further include an application to extract payment information from the acquired image.